Boost your holiday sales with a “pay later” option

The countdown to the holiday season has begun – and we are entering what is traditionally the most lucrative time of the year for the retail sector. Record inflation levels, however, have the potential to curb German shoppers’ willingness to buy. If you, as a merchant, are looking to push sales as the end of the year approaches, it’s important to cater to your customers’ changing needs: Consumers today expect the financial flexibility of “pay later” options when shopping online.

In this post, the technology PayPal outlines the benefits of these options.

Unplanned expenses in the run-up to the holiday season usually hit harder than at other times of the year. Imagine one of your customers is planning to buy a gift for their loved one when, out of the blue, the washing machine or the refrigerator breaks down. In situations like this, flexible payment options can save your customer’s Christmas. Given the many benefits of “pay later” options, consumers today expect to be offered them when shopping online: According to a study, 66% of consumers use “pay later” options because they allow them to make purchases without having to save up first. And 60% appreciate having the time to examine the ordered items before payment is taken.[1]

PayPal Checkout: A whole range of payment options

PayPal Checkout is designed to help you to meet your customers’ expectations. The new, all-in-one solution for online retail not only includes all the standard payment methods used in this country – payment via PayPal, direct debit, credit or debit card, and depending on availability, payment on the invoice – but also a choice of local payment methods that are popular abroad. It also offers flexible payment options – “Pay in 30 Days” and “PayPal Installments”. [2]

Offering a wider selection of payment options increases your chances of optimizing your conversion rate. That’s particularly important this year, as high inflation looks set to dampen German shoppers’ willingness to buy in the run-up to Christmas. PayPal’s “pay later” options help you cater to your customers’ need for financial flexibility when shopping online, overcome the prospect of reduced sales and take full advantage of this most lucrative time of the year.

And the best thing about it for you? While your customers pay later with both “Pay in 30 Days” and “PayPal Installments”, you, as the merchant, get paid upfront – at no additional costs to your business.

Meeting customer expectations with “pay later” solutions

PayPal Checkout includes two “buy later” options:

“Pay in 30 Days” offers your customers more time to make the payment. Payment is automatically taken by direct debit after 30 days – without any additional costs. With “Pay in 30 Days”, your customers benefit from financial flexibility and also enjoy the security of PayPal’s Buyer Protection. Customer data is also protected by complex encryption.

“PayPal Installments” offers your customers a more relaxed schedule for their payments. Larger purchases can be paid for in installments over a period of three, six, twelve, or 24 months. If you are looking to boost satisfaction levels among regular customers and win new customers, you can also offer the option of 0% finance.[3]

The visibility of “pay later” options is key!

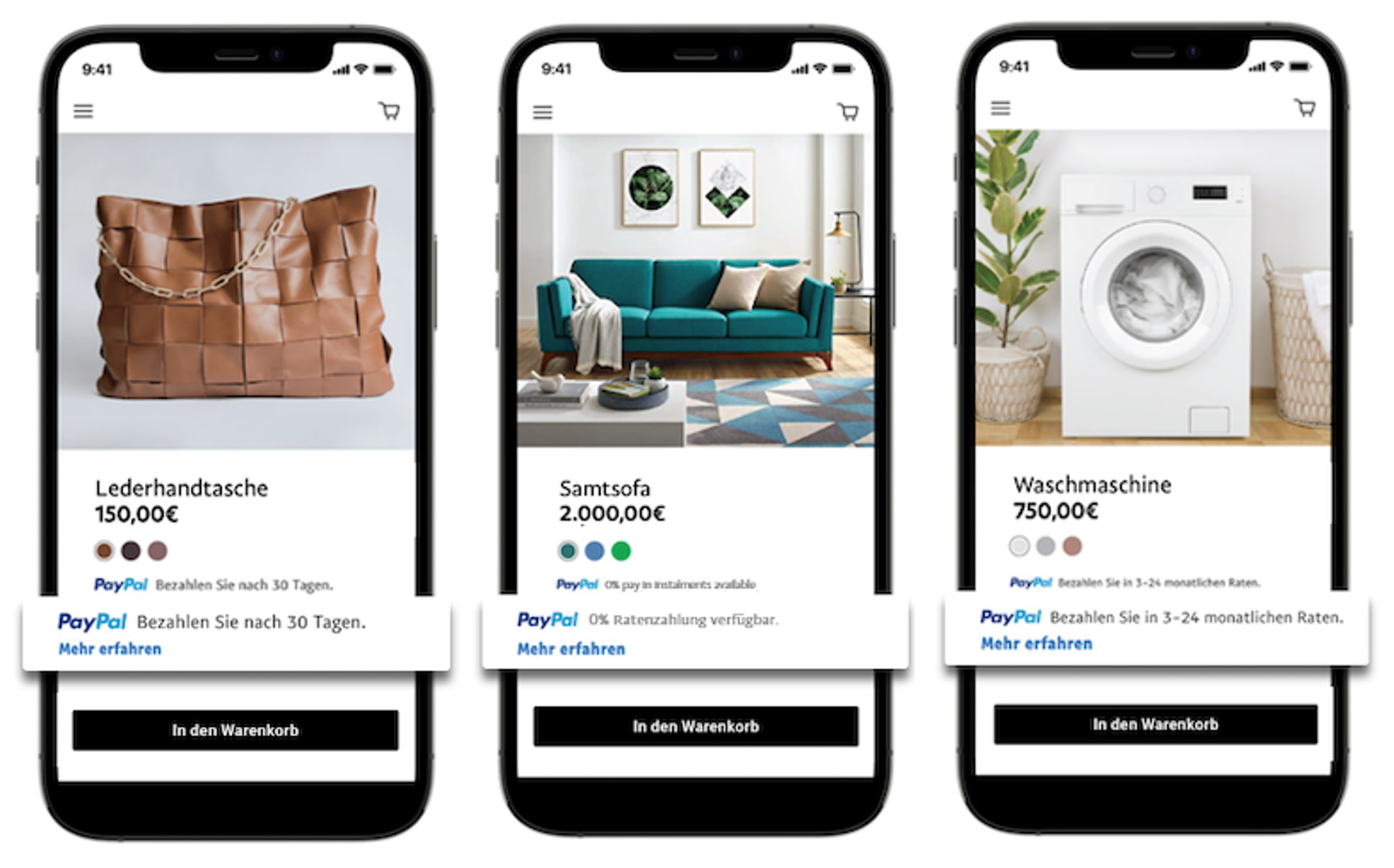

If you want to optimize your conversion rates, “pay later” options are essential. 30% of consumers who fail to find these options during their shopping experience cancel their online purchases. [1] So make sure that your customers notice that you’re offering “PayPal Installments” and “Pay in 30 Days” during this peak-sales season.

Did you know that PayPal Checkout makes it easy for you to point out PayPal’s “pay later” options in different areas of your online shop? Place the new “pay later” button or the dynamic banner highlighting the “PayPal Installments” or “Pay in 30 Days” options at key points in the shopping journey – on the product detail page, in the shopping cart, and during the payment process. Before they decide whether or not to purchase, let customers know that flexible payment options are available in your online store and increase the probability of higher value shopping carts: Using the dynamic banner with PayPal Checkout can triple your “pay later” sales. [4]

Full transparency and control for your customers

Clicking on your “Pay later” button or the dynamic banner takes your customers directly to the available options in their PayPal account. They will be shown the “pay later” details that are relevant to their purchases. The variant displayed will depend on the value of the shopping cart. “Pay in 30 Days” appears if the shopping cart value is between EUR 1 and EUR 1,000, while “PayPal Installments” appears for shopping carts between EUR 99 and EUR 5,000. With the latter option, the choice of monthly installments is also displayed – making it easier for the customer to decide to buy.

An option for customers without a PayPal account: New payment on invoice in PayPal Checkout

Following the inclusion of payment on invoice as part of PayPal PLUS from September 30, 2022, PayPal Checkout now also offers you a new payment on invoice solution. In Germany, shoppers are particularly fond of this method of payment as they do not need to enter sensitive payment data and can examine the goods at their leisure before paying. After 30 days, your customers pay the invoice themselves by making a bank transfer. There is no automatic direct debit as with “Pay in 30 Days”. Here too, however, you, as the merchant, get the money from PayPal upfront, without any red tape. Plus: your customers don’t even need a PayPal account for this payment type.

Activate PayPal Checkout quickly and easily

With the new PayPal Checkout, you’re all set for the festive season. The new all-in-one solution is quick and easy to activate via Shopware. Find out more here:

Cre: shopware